A Conductive Measure of Chinese Monetary Policy

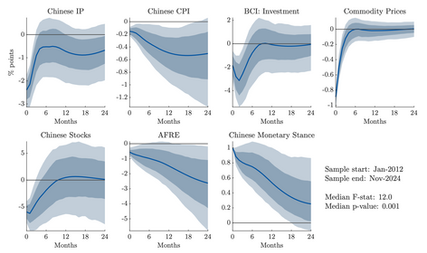

[with Refet Gürkaynak and Mahmut İpek] We identify monetary policy shocks by the People’s Bank of China (PBoC) using high-frequency intraday movements in copper futures traded on the London Metal Exchange. Leveraging the strong link between copper prices and Chinese economic activity, we construct a novel market-based measure of unexpected monetary policy news around PBoC announcements. An event-study framework quantifies the immediate market response, while a structural VA

Domestic and Foreign Monetary Policy Transmission in the West African Economic and Monetary Union

A set of preliminary results ( with Emanuele Savini, Elena Scola Gagliardi, and Anshumaan Tuteja)

Decomposing Monetary Policy Surprises: Shock, Information, and Policy Rule Revision

Two explanations exist for the output and price puzzles arising from the identification of monetary policy shocks with high-frequency...

Monetary Policy, Information and Country Risk Shocks in the Euro Area

[ CEPR wp ] with E. Savini and A. Tuteja This study examines high-frequency market responses to ECB policy announcements, providing...

Foreign Exchange Interventions and Intermediary Constraints

We study the impact of foreign exchange interventions during periods of tight credit constraints. Expanding on the Gabaix and Maggiori...

A Hundred Years of Business Cycles and the Phillips Curve

This study investigates the business cycle dynamics of the U.S. economy since 1900 through a multivariate framework that imposes minimal...